(Edited 3/26/20)

Once enacted into law, Senate Bill 751 provides that no employee of any school entity who was employed as of March 13, 2020 shall receive more or less compensation that the employee would otherwise have been entitled to receive from the school had the COVID-19 pandemic not occurred.

In addition, the federal legislature enacted paid leave protections for all government employees under the Families First Coronavirus Response Act (“FFCRA”) effective April 1, 2020 through December 31, 2020.

The following is a question and answer guide to understanding how these two laws work together and practically apply to schools.

Who qualifies as “employees” under SB 751?

The pay protections of SB 751 would extend to anyone who meets the following criteria: (1) The individual was hired by Board appointment, as opposed to an outside contractor; and (2) the individual receives pay on a regular (as opposed to sporadic) basis. If they meet the above requirements, substitutes may be considered “employees” for the purpose of applying SB 751. Anyone who receives a fee under an independent contractor agreement would not fall under the definition of “employee.”

Can a school require employees to work remotely?

Yes, unless the employee has requested and meets the criteria for leave under the FFCRA or another type of leave. There is nothing under SB 751 that divests schools of their managerial prerogative to assign tasks. To enforce a remote work procedure with unionized employees, schools may wish to enter into a memorandum of understanding with the union.

When is a school precluded from requiring remote work?

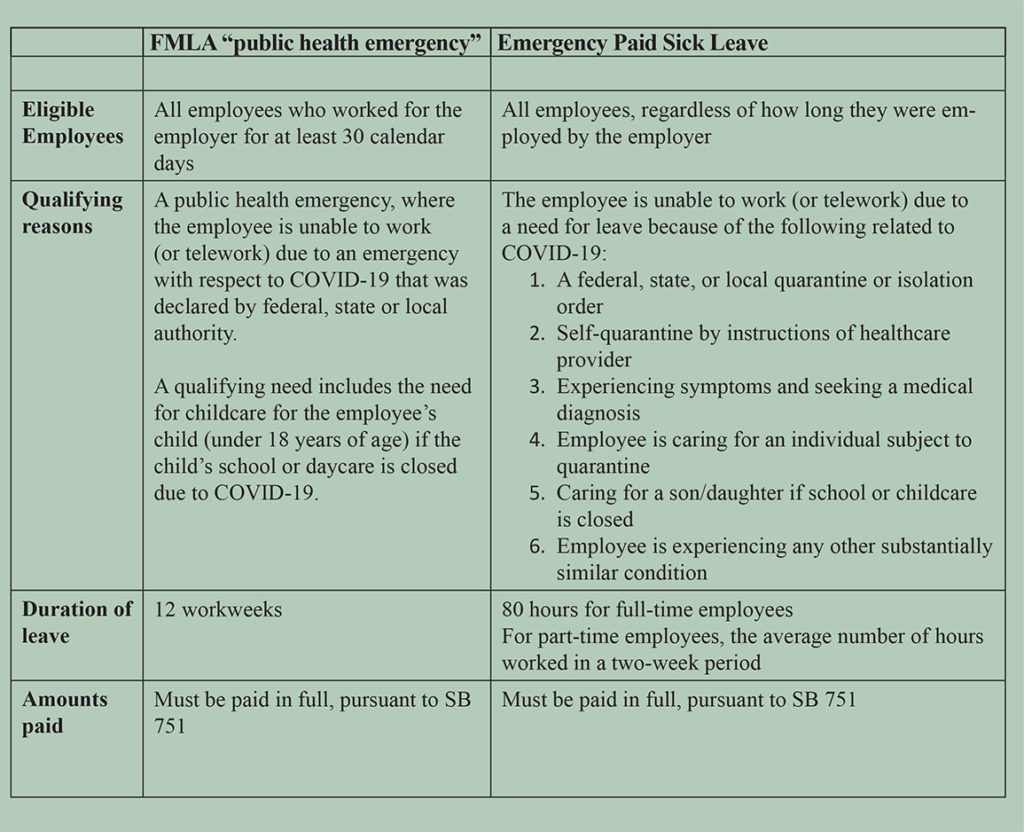

When an employee requests and meets the criteria for leave under the FFCRA or another form of leave provided by law, contract, or policy. The FFCRA provides two leave requirements related to COVID-19 including:

- An extension of the Family Medical Leave Act (FMLA) to leave for a “public health emergency” and

- Emergency Paid Sick Leave

The following chart provides basic information about both types of leave:

For employees who have already used FMLA leave time, does the FFCRA’s extension of the FMLA entitle employees to more than the 12 workweeks of leave than they already took?

No. The FFCRA adds “public health emergency” as another qualifying reason for FMLA leave. If employees have already taken their 12 workweeks of leave during the applicable 12-month period, the FFCRA’s extension of the FMLA does not give them additional time. However, as will be explained below, the FFCRA’s Emergency Paid Sick Leave may provide the employee with additional leave.

Can employees use FMLA leave related to a public health emergency on an intermittent basis?

No. An employee must take FMLA leave for a public health emergency leave as consecutive days of leave and is not entitled to intermittent leave for public health emergency reasons. However, the FFCRA’s Emergency Sick Leave is not similarly restricted. Employee may be eligible to use Emergency Paid Sick Leave intermittently.

Can the employer require employees to substitute accrued paid leave or Emergency Sick Leave during the first ten days of unpaid FMLA leave?

No, substitution is at the sole discretion of the employee. The above only applies to FFRA’s extension of public health emergency FMLA leave, however, and does not amend the FMLA for any other qualifying reason.

Is an employee entitled to both FMLA leave and Emergency Paid Sick Leave?

Yes, covered employers must provide both types of leave to eligible employees.

How do the FMLA and Emergency Paid Sick Leave work together?

These two forms are leave are applied together as follows:

- Employees who are eligible for both leaves are entitled to both.

- If an employee has already exhausted his/her FMLA leave entitlement, the employee may still be entitled to Emergency Paid Sick Leave.

- Although employees are not entitled to take intermittent FMLA leave for a public health emergency, there is no restriction on employee’s ability to use Emergency Paid Sick Leave intermittently.

If employees who are eligible for emergency FMLA leave request Emergency Paid Sick Leave, may I designate the leave as FMLA-qualifying even if the employee has not specifically applied for FMLA leave?

The answer is unclear. At this time, employers may be best advised to err on the side of caution in only designating FMLA leave where specifically requested.

Generally speaking, once employees communicate a need to take leave for an FMLA-qualifying reason, employers are required to designate the leave as FMLA-qualifying, even where employees have not specifically requested FMLA leave. However, for paid FMLA leave under the FFCRA’s FMLA expansion, the application of this general rule is unclear. The FFCRA specifically states that employees may not be compelled to use paid leave and gives employees the sole discretion to substitute paid for unpaid days.

How can employers comply with the FFCRA’s notice obligations when the workplace is closed?

The Department of Labor’s guidance provides that notice requirements may be met by displaying the notice where all employees can see and distributing the notice electronically. Therefore, employers with closed offices may comply with the FFCRA by positing notice on their website, or another group access point for all employees, and sending notice to all employees electronically.

The Department of Labor has released a model notice for employees that meets the requirements of the FFCRA.

Are employees entitled to Emergency Paid Sick Leave in addition to what an employer already offers?

Yes, employees are entitled to Emergency Paid Sick Leave as an additional form of paid leave. Under the FFCRA, employers may not require employees to exhaust other paid leaves before using Emergency Paid Sick Leave. Existing paid leave will not meet the requirement, regardless of how much paid leave the employer currently offers.

Please do not hesitate to let us know if we can answer any other questions.

HR Law Update is a publication of the KingSpry Employment Law Practice Group. School Law Bullets are a publication of KingSpry’s Education Law Practice Group. This article is meant to be informational and does not constitute legal advice.